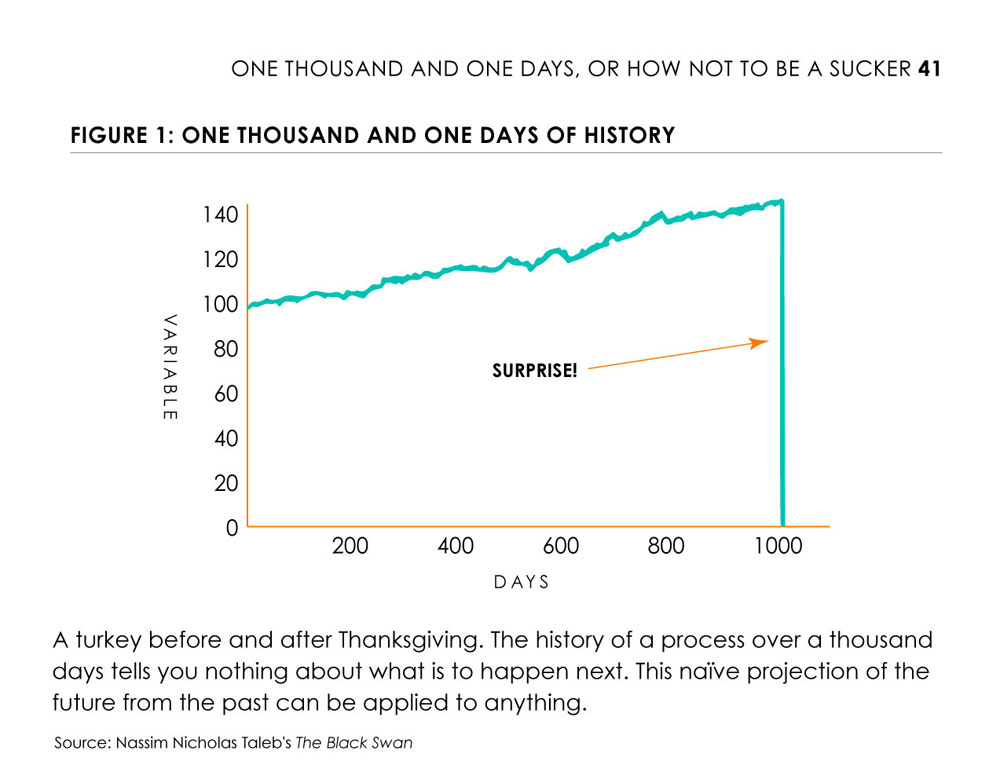

In his book, “The Black Swan: the Impact of the Highly Improbable,” Nassim Nicholas Taleb describes how the world has been shaped by a series of massive shifts in established systems: change events that virtually no one saw coming. “The way things have always been” suddenly gets turned on its head. Taleb makes the case that our assumption that established systems will persist indefinitely makes us blind to the possibility of potentially earth-shattering changes, like the fall of the Berlin Wall or the attacks of 9/11.

Taleb uses the life of the turkey to illustrate the point:

Graphs like this are sometimes cited to warn of things like ecosystem collapse. And when we think of the Black Swan and the climate crisis we can be forgiven for dwelling on the negative. But Black Swan events also describe positive change.

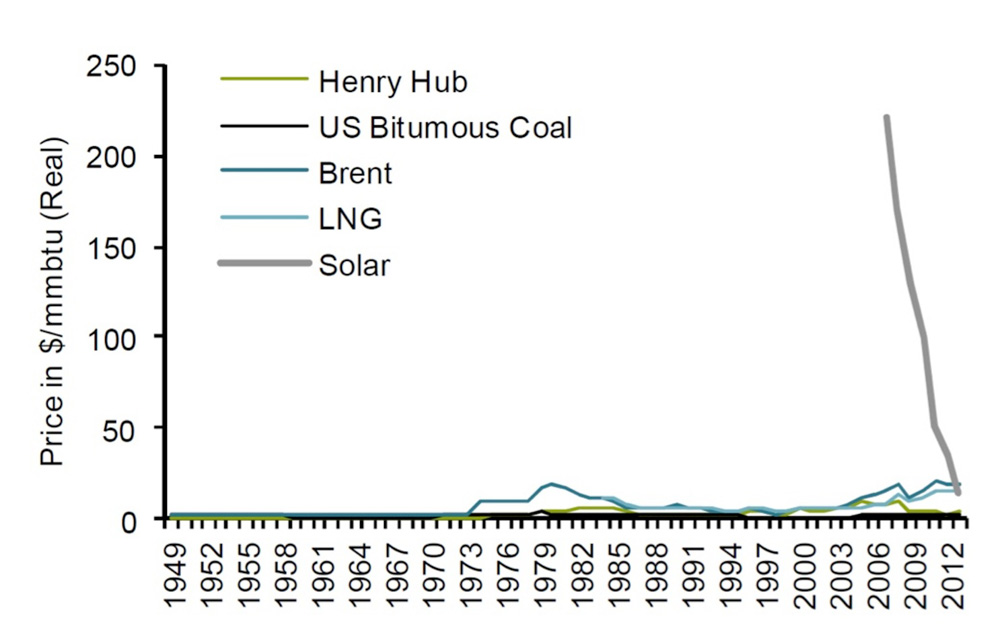

Take a look at this jaw-dropping graph from a report by the investment bank Sanford Bernstein, for example:

The wavering lines across the bottom of the graph show the price of fossil fuel-generated energy. The dive-bombing line at the right shows the price of solar energy falling from the sky out of nowhere, very much like a Black Swan. Solar energy is suddenly giving dirty energy a run for its money.

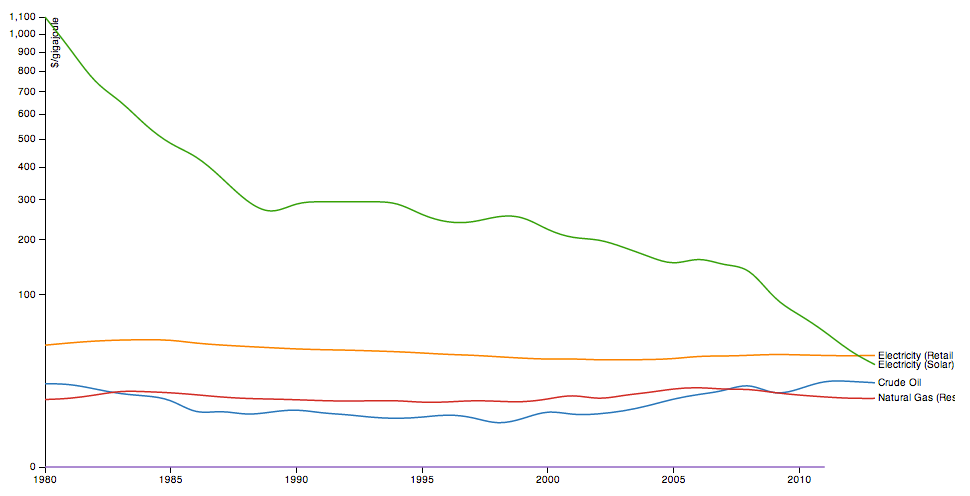

This graph below by Brian McConnell shows the same thing, but with a logarithmic y-axis that visually flattens the game-changing drop in solar price.

It looks like solar energy will disrupt energy markets and conventional dirty energy production very soon.

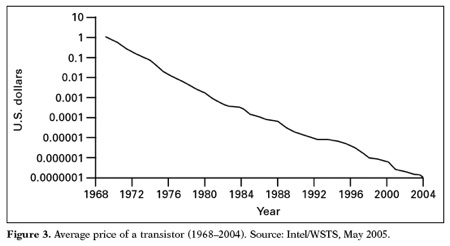

You know how computer chip innovation is described by “Moore’s Law,” that says that the size of chip transistors halves every 18 months? Here’s what that does to the price of computing power:

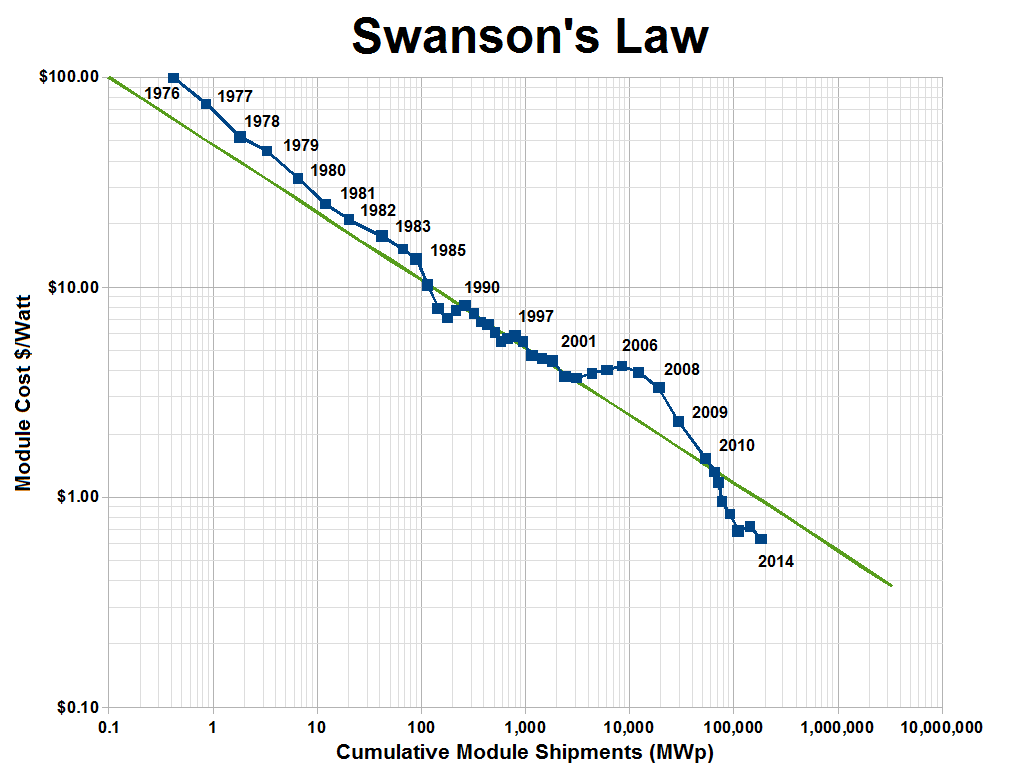

Like computer chips (and unlike oil) solar energy is a technology. So innovation can be a big deal. It turns out that solar panel price follows something akin to Moore’s Law, called “Swanson’s Law,” that says that solar panel price decreases by 20% for every doubling of global manufacturing capacity. Here’s what that’s doing to the price of solar energy:

We’re seeing similar decreases in wind power and battery cost, too. (Have you noticed what Elon Musk is up to lately?)

Now I know I’m mixing world views here: one (the Black Swan) saying we’re unwise to predict the future based on the past, and the other (Swanson’s Law) saying that we’re safe to assume that future drops in solar energy costs will continue along past trajectories.

But here’s my point: we’re in game-changing, system-disrupting, exponential growth territory with renewable energy right now. As we contemplate the 59% reduction in global CO2 emissions that the International Energy Agency says is necessary by 2050 to limit warming to 2 degrees C, this provides some hope.

For more musings about renewables, climate change, and how they relate to high performance buildings, check out these posts:

Is Solar Smart? Reaching Net Zero, Part I

On the Jevons Paradox, Climate, and Fighting Defeatism

(Black Swan photo by Russell Street, some rights reserved under a creative commons license.)

Back to Field Notes