Money.

That’s why we won’t dig up all the fossil fuels in the Earth and burn ‘em.

Sounds counterintuitive, right? After all, big fossil fuel companies have kajillions of buried fossil fuel resources and reserves on the books that they’re banking on. That’s a lot of skin in the game.

Isn’t it inevitable that they’ll just “drill, baby, drill”?

And if they do, what’s the point of energy efficient building? If we’re just gonna burn it all anyway, energy efficiency just delays the inevitable, right? Better to invest in life rafts and watch the Antarctic melt. Bring on 200’ sea level rise!

I don’t mean to be flippant about the risks of climate change. They are colossal and we as a species have done little so far to avoid them. But new math has emerged that provides hope for meaningful climate action – and, incidentally, gives über-efficient buildings a starring role in climate solution-making.

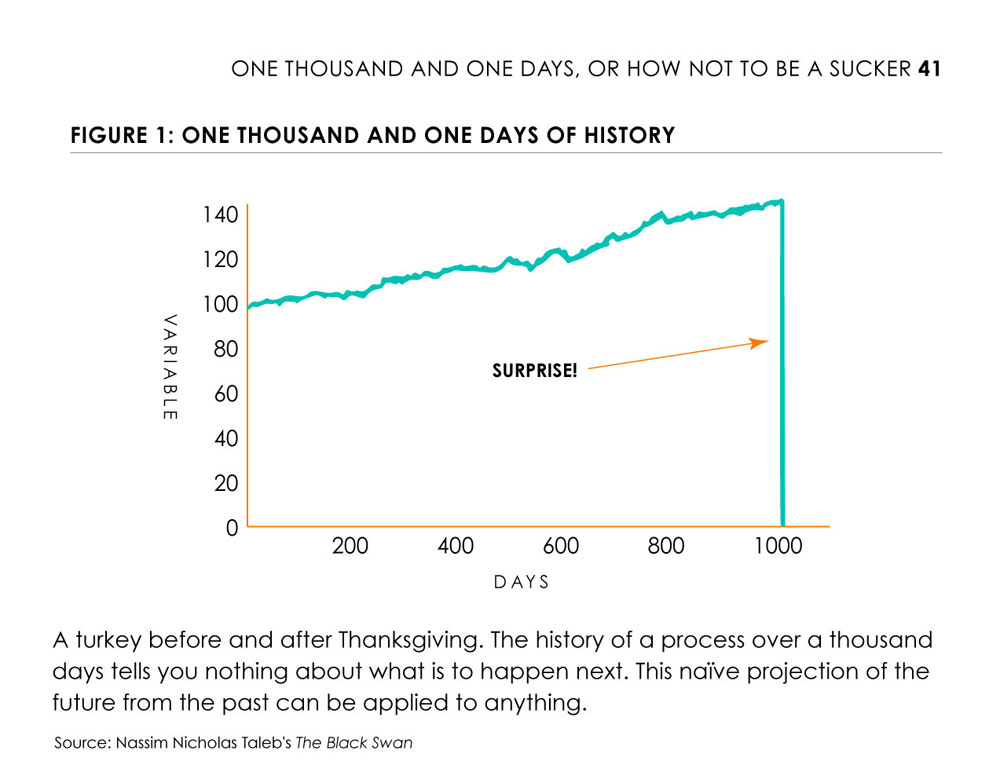

A couple months ago I wrote about the concept of the Black Swan event, how such events can describe many unexpected turning points in human history (both good and bad), and how we may be experiencing a Black Swan event in renewable energy right now. Here’s Nassim Nicholas Taleb’s (author of The Black Swan) classic illustration, showing the Black Swan event of Thanksgiving and its effect on the life of a turkey:

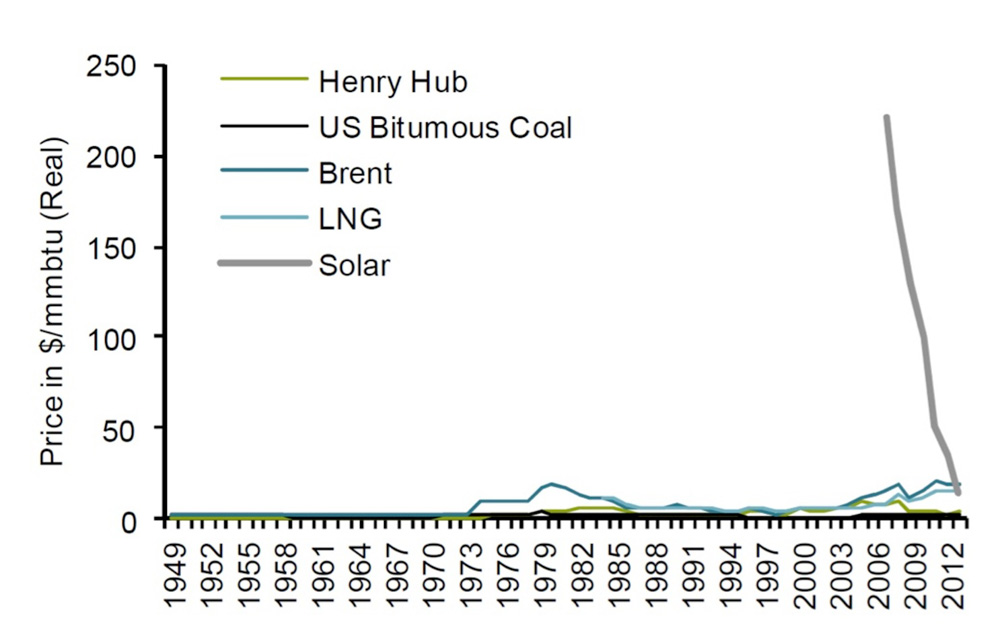

The investment firm Sanford Bernstein (no slouches, they manage $454 billion in assets) recently shared a graph with its energy investors that looks a lot like a Black Swan:

Sanford Bernstein knows this is big news, hence the title, “Welcome to the Terrordome.” The graph shows the wavering lines of the status quo along the bottom: the price of dirty energy produced by the burning of fossil fuels. Then, falling from the sky out of nowhere, comes solar energy, suddenly beating dirty energy on price in developing markets.

The cost of renewable energy is in a nose dive thanks to innovation. Solar and wind energy are technologies, not fuels, so they benefit from the learning curve that comes with ramping up technology at scale. This learning curve in the solar sector is called Swanson’s Law (akin to Moore’s Law in the microchip industry), and it shows that the price of solar modules goes down by 20% with every doubling of global deployment of solar modules. Here’s what that looks like:

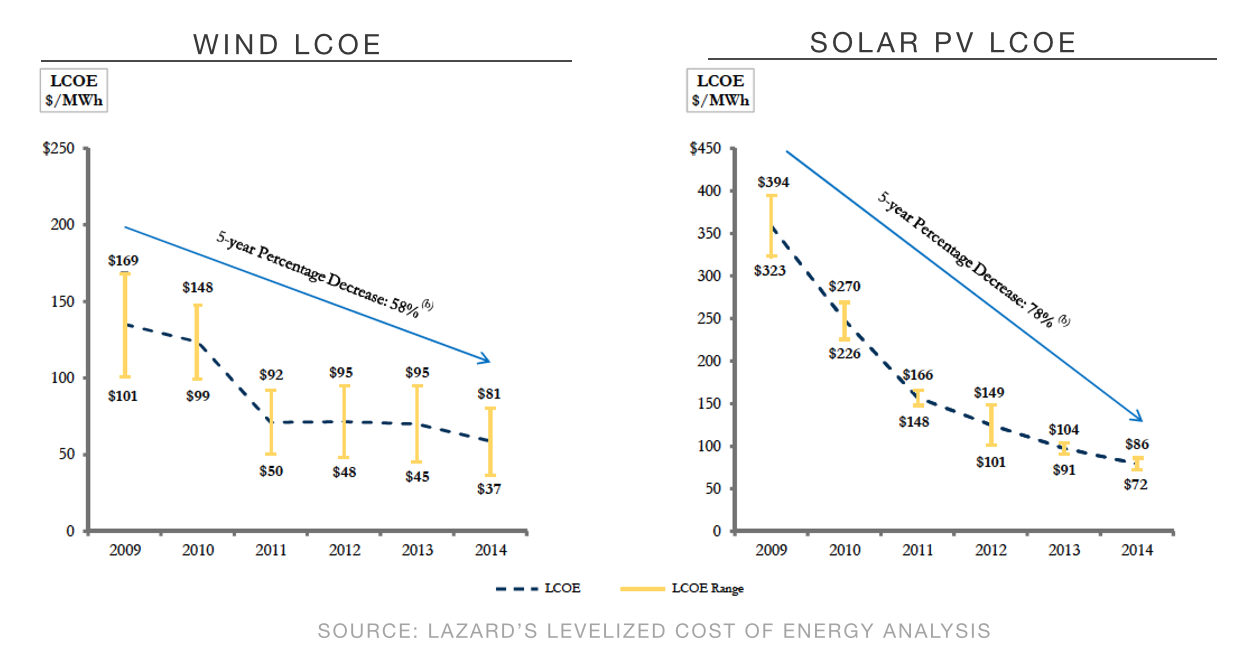

Incredibly, the price of solar modules has gone down by 99.6% since 1977. And this trend isn’t slowing. According to investment banking firm Lazard, solar’s levelized cost of energy (the per-kWh cost of building and operating a generating plant over an assumed financial life and duty cycle) has dropped 78% in the past five years alone, as seen in the graph to the right:

The cost of wind energy, shown in the graph to the left above, is also decreasing rapidly, though not quite as fast as solar. Wind has a big head start on solar at the utility scale, however – it’s already considerably cheaper.

What does this have to do with whether fossil fuel companies will drill it/dig it all up?

Renewables will impact fossil fuel prices.

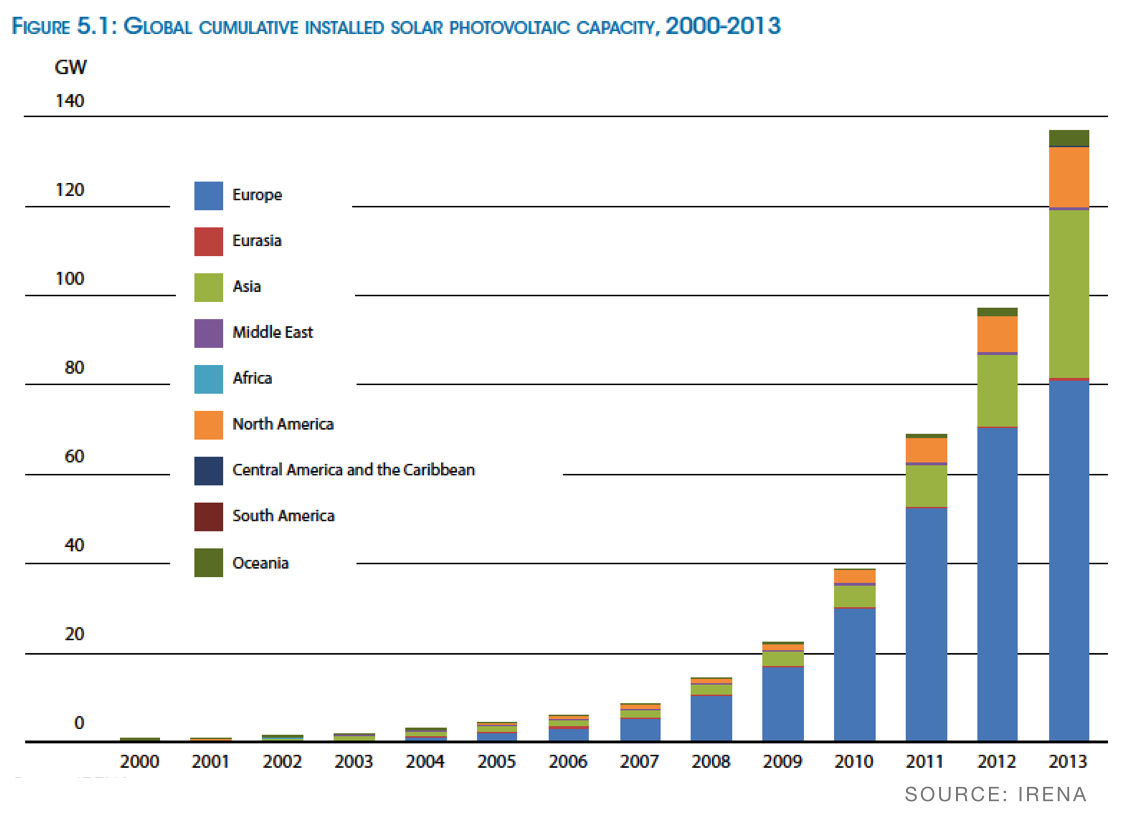

Sanford Bernstein’s report to its investor concludes that plummeting renewable energy prices will begin to drag oil, coal, and gas prices down. It’s not happening yet because renewables still aren’t a big enough piece of the energy pie, but it’s coming soon. Analyst Michael Park writes that the solar sector will have to grow by an order of magnitude to begin depressing fossil fuel prices. That may seem like a lot, but growth in global solar deployment is absolutely explosive right now:

Between 2011 and 2013 global solar panel installations DOUBLED. If that rate of increase holds, it won’t take more than a few years for solar deployment to increase by 10 times and reach the critical mass necessary to begin depressing fossil fuel prices.

We’re so accustomed to thinking about the potential for cheap oil prices to slow renewable energy adoption, but the reverse is becoming true. According to Michael Liebreich, chairman of the advisory board at Bloomberg New Energy Finance:

“The orthodox view of unlimited oil demand growth simply does not hold in a world of super-efficient engines, electric vehicles, desperate air pollution problems, and action on climate. The US economy has grown by 8.9% since 2007, while demand for finished petroleum products has dropped by 10.5%. Improvements in gas mileage and reductions in miles driven per person have had more impact on cutting US oil imports than unconventional production. The story should not be how falling oil prices will impact the shift to clean energy, it should be how the shift to clean energy is impacting the oil price.” (emphasis added)

Of course, fossil fuel companies care a lot about price. If prices dip below the breakeven point for extraction then they can’t make money drilling or digging. The costs of extraction outweigh sales revenue. So fossil fuel assets become stranded in the ground.

(NOTE: the concept of “stranded assets” has become an important one in the global dialogue over climate change. And it’s not just price that can strand a fossil fuel asset in the ground. It is also the imperative – enforced through regulation or supported by carbon pricing – to keep a significant portion of fossil fuels buried in the ground to avoid catastrophic levels of climate change. As Bank of England governor Mark Carney said, “the vast majority of reserves are unburnable.”)

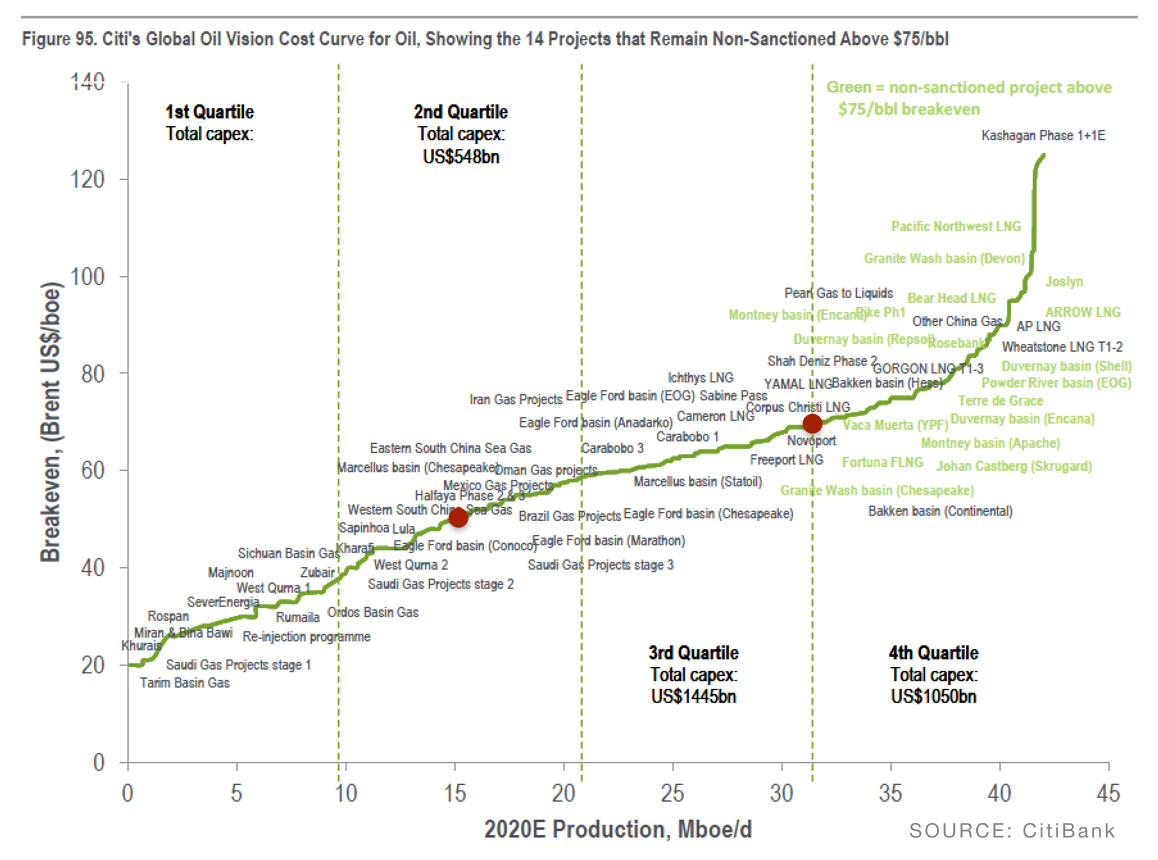

This Cost Curve for Oil graph prepared by Citi (CitiBank) illustrates the relationship between price and stranded assets:

The green line charts the cost of a barrel of oil, and represents the breakeven point for various oil projects around the world. When Citi prepared the graph several months ago, the cost of a barrel of oil was $75, represented here by the dot on the right. At that price, all oil projects in green in the right quadrant of the chart are “non-sanctioned,” not economically viable at that price. Since this chart was published a few months ago, the price of oil has dropped to just below $50 per barrel today, represented by the red dot on the left. At that price, two-thirds of the oil projects shown here are called into question. It’s just too expensive to extract the oil at that price. Now imagine what would happen if cheap renewable energy began to drag the dot further down along that cost curve. Then imagine the impact of a price on carbon.

The relationship between oil price and oil exploration and extraction really hit home recently when Shell announced its unexpected exit from the Arctic. Just a few months before, hundreds of activists in Portland and Seattle were protesting Shell’s Arctic operation, with “kayaktivists” in Seattle surrounding the Polar Pioneer oil rig in Elliott Bay for days and aerial activists hanging from Portland’s St. Johns Bridge to impede the departure of Shell’s ice breaker, the Fennica. Certainly the folks at Shell noticed this civil disobedience. But the low price of oil was the clincher in their cost/benefit analysis. The endeavor just wasn’t worth it for Shell.

Great! So the market will just solve our climate ills?

Not so fast. Despite the exponential growth in renewable energy, the transition from dirty energy to renewable energy is not happening fast enough to avert severe climate disruption. As global population expands and economic development unfolds, our global appetite for energy is surging. Major investments in renewable energy deployment and renewable energy R&D are necessary if we are to successfully transition away from fossil fuels. The energy playing field needs to be leveled through carbon pricing and a shift away from energy subsidies for fossil fuels. And lots more needs to be done besides – see “Seizing the Global Opportunity” by The New Climate Economy to learn more.

But the renewable energy revolution has opened up a course to meaningful climate action. We’re now in a position of accelerating virtuous cycles, not just bemoaning destructive ones. More clean energy and storage means cheaper clean energy and storage which, together with more energy efficiency, makes fossil fuel extraction less and less viable. Our task is to help clean energy out-compete dirty energy faster than it is already doing.

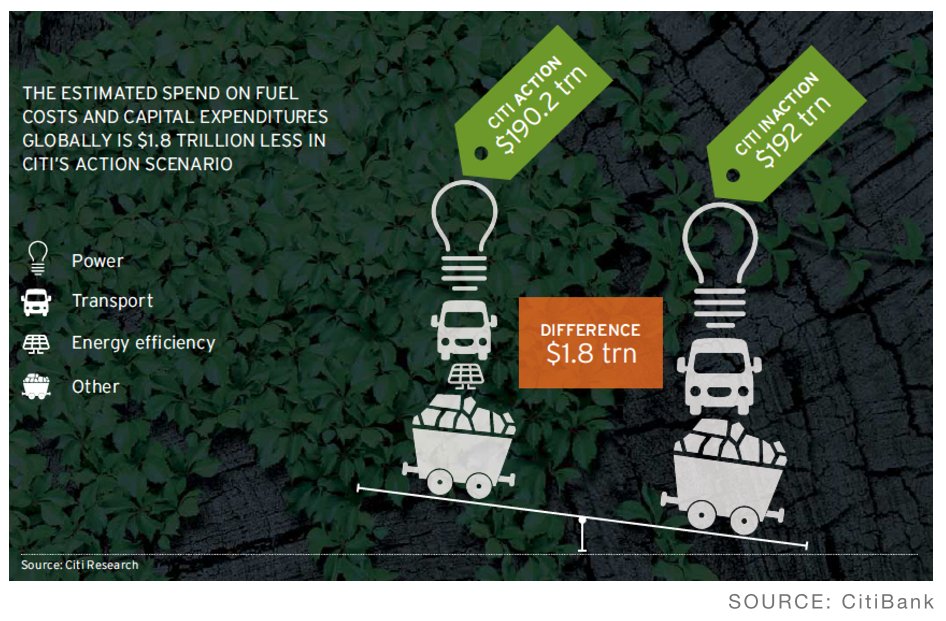

It is a race, but one we have a chance at winning. In fact, the price tag for a winning effort will be cheaper than for a losing one, according to Citi. In its report, Energy Darwinism II, Citi finds that the fuel costs and capital expenditures for “Climate Action” (defined as a shift in global energy generation and efficiency investments that targets 2 degrees Celsius of warming) would be $1.8 trillion LESS by 2040 than business as usual. And that’s not accounting for the tens of trillions of dollars saved in societal costs from the runaway warming that would be caused by business as usual.

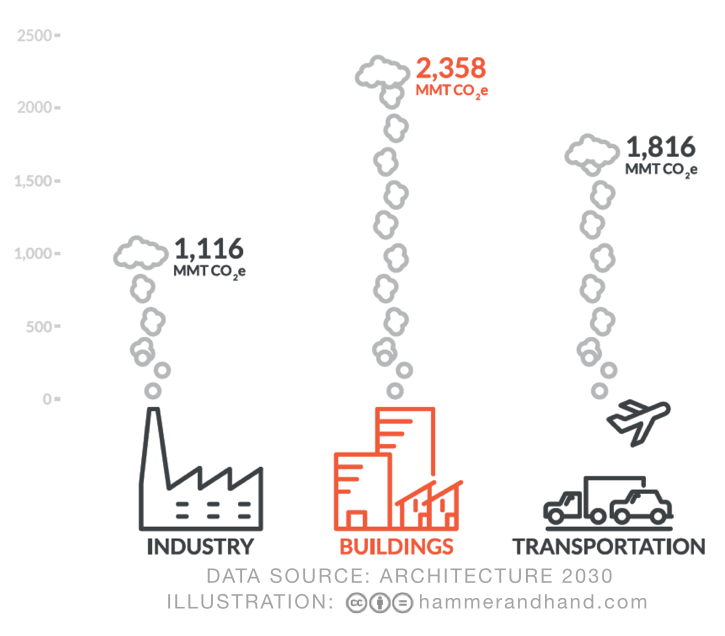

Über-efficient buildings like Passive Houses, Living Buildings, and Zero Energy Buildings will be a key piece of the puzzle. Today buildings account for nearly half of US greenhouse gas emissions, but we know how to dramatically reduce that number.

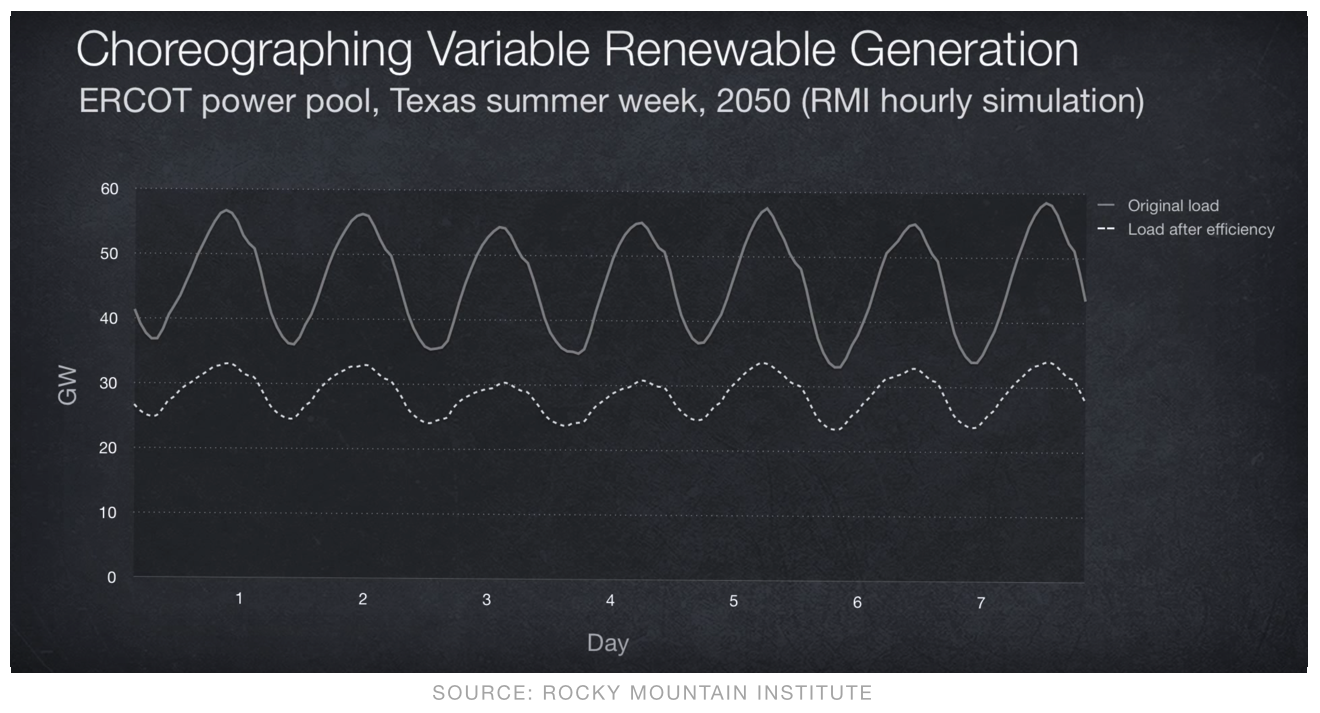

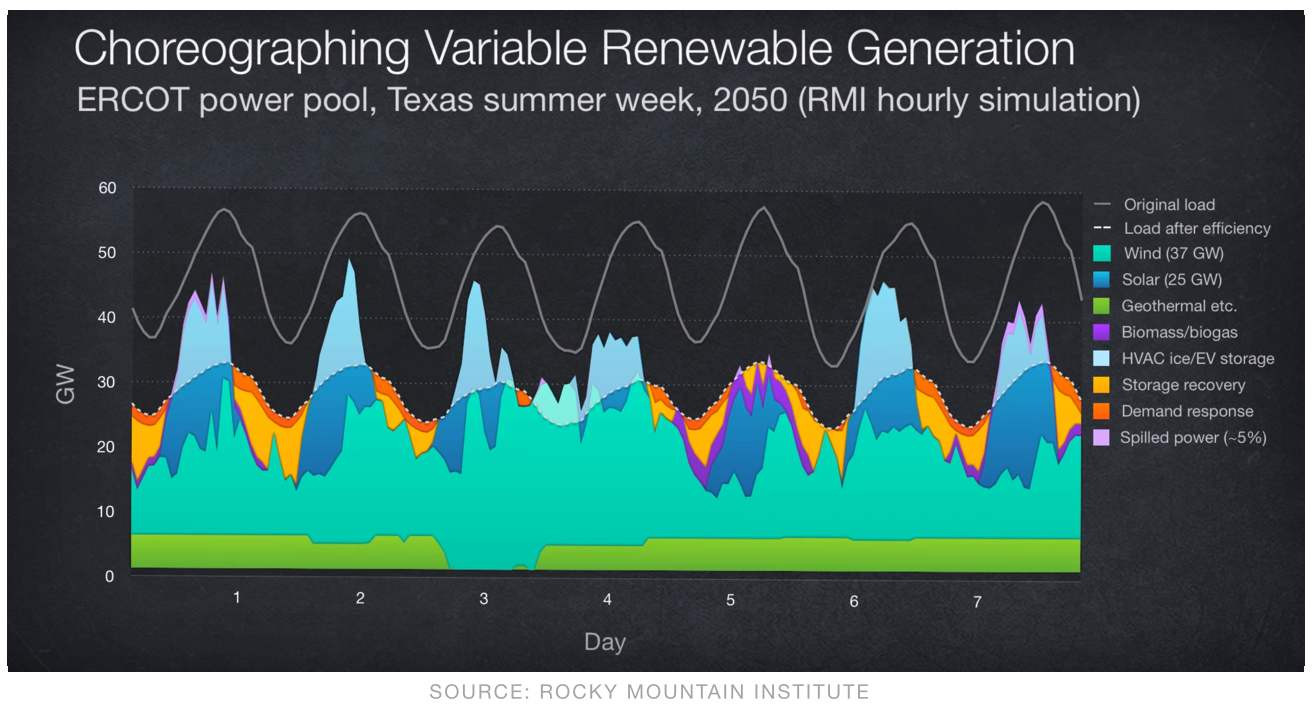

Energy efficient buildings make a clean energy grid more practical by both reducing overall energy demand and by flattening out the peaks and valleys in that demand, as this frame from Rocky Mountain Institute’s video, The Storage Necessity Myth, shows:

It then becomes easier to fill in the gaps with a mix of renewables and storage:

So. Will fossil fuel companies dig it all up and burn it? Unlikely. The question is how much of it can we keep in the ground. Can we transition away from dirty energy fast enough to keep warming to 2 degrees Celsius or less?

The race is on.

(Oil Rig photo by Eric Kounce, some rights reserved under a creative commons license.)

Back to Field Notes